Stocks on Bursa Malaysia ended lower across the board yesterday as investors turned cautious ahead of the US Federal Reserve’s Federal Open Market Committee meeting on Wednesday, in line with regional trend as lingering concerns remained over global financial markets growth after China released poor August trade and sluggish industrial production and investment data. The FBM KLCI fell 3.51 points or to 1,621.04 from last Friday’s closing of 1,624.55 after opening 0.44 of a point higher at 1,624.99 and hovered between 1,619.09 and 1,629.19. Losers led gainers by 520 to 220 while 297 counters closed unchanged. Total turnover declined to 876.44 million shares valued at RM1.44 billion from 1.14 billion shares worth RM1.72 billion last Friday.

Stocks on Bursa Malaysia ended lower across the board yesterday as investors turned cautious ahead of the US Federal Reserve’s Federal Open Market Committee meeting on Wednesday, in line with regional trend as lingering concerns remained over global financial markets growth after China released poor August trade and sluggish industrial production and investment data. The FBM KLCI fell 3.51 points or to 1,621.04 from last Friday’s closing of 1,624.55 after opening 0.44 of a point higher at 1,624.99 and hovered between 1,619.09 and 1,629.19. Losers led gainers by 520 to 220 while 297 counters closed unchanged. Total turnover declined to 876.44 million shares valued at RM1.44 billion from 1.14 billion shares worth RM1.72 billion last Friday.

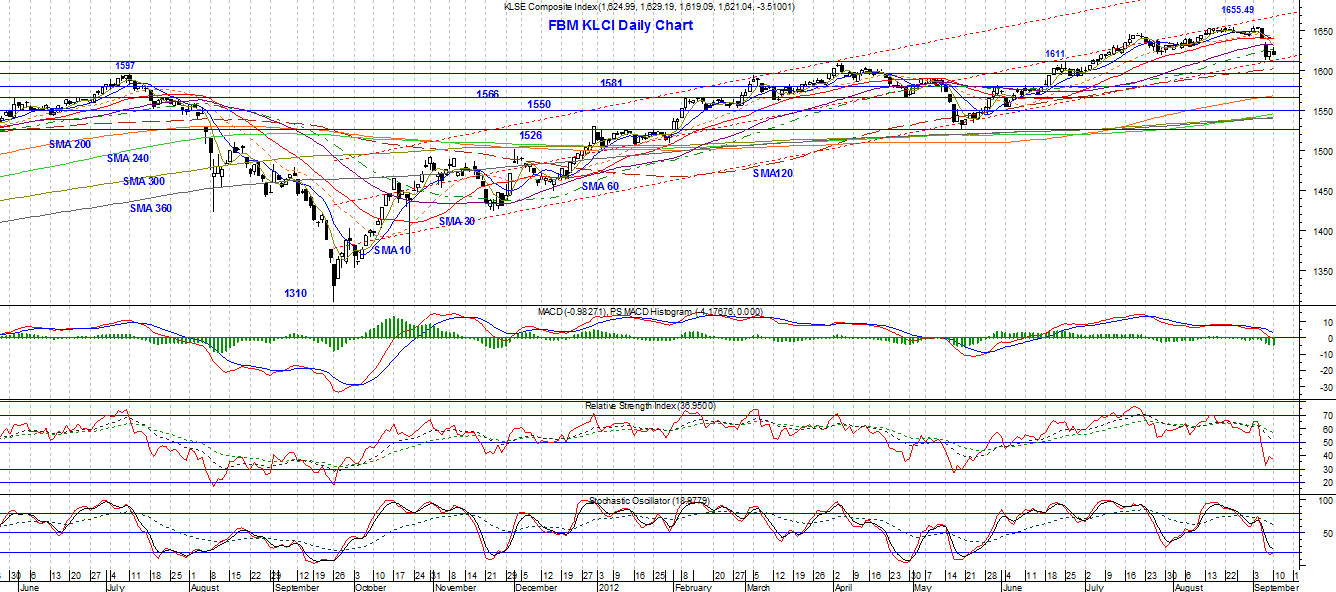

The FBM KLCI opened 0.44 point higher at 1,624.99 and moved higher to touch the intra-day-high of 1,629.19 within the first hour of trading. The key index then slipped on heavy profit-taking which sent it to the intra-day low of 1,619.09 before rebounding slightly to close off low. Chart-wise, the FBM KLCI formed a dark-cloud-cover candlestick pattern which indicates heavy profit-taking after a strong rebound on last Friday, and the key index is likely to further correct or consolidate today with immediate critical support at 1,613-point. If this support cannot hold, then the FBM KLCI is likely to slip lower to the 1,600-point level.

MACD and its histogram continued to slip lower and further extended southward. The MACD line has just crossed below the zero-line, flashing out a sell signal, indicating the FBM KLCI's bull trend is over and has entered a bear phase. RSI (14) hooked downward to 36.9, reflecting the pullback and a bearish state of the key index. Stochastic hooked upward slightly to 18.9 from 16.4, indicating short term oversold and a weak market strength. Readings from the indicators showed that the FBM KLCI is currently bearish and is likely to further correct or consolidate.

The short term trend is down, and the medium term trend has also turned bearish as the FBM KLCI is now staying below the 50 and 60-day SMA. The long term trend, nevertheless, is still up but will be subjected to test soon as the 100 and 120-day SMA are now at 1604 and 1602. A break below these two long term moving averages would confirm a bear market. Immediate downside support zone is at 1,613 to 1,600, while the overhead resistance zone remained at 1,635 to 1,641.

Overnight, the Dow loss -52.35 points or -0.39% to close at 13,254.29. Today, the FBM KLCI is likely to trade within a range of 1,606 to 1,639.

This week's expected range: 1588 – 1673

Today’s expected range: 1606 – 1639

Resistance: 1627, 1633, 1639

Support: 1606, 1613, 1617