Stocks on Bursa Malaysia ended yesterday mixed due to persistent selling pressure on small-cap stocks. However, gains in heavyweights helped pushed the benchmark FBMKLCI 3.6 points or 0.19% higher to 1,859.34 points, after opening 3.47 points lower and hovered between 1,852.27 points and 1,859.34 points. Market breadth was extremely negative as losers led gainers by 728 to 192 while 256 counters were unchanged. Turnover was higher at 2.5 billion shares worth RM2.2 billion from Monday’s 2.16 billion shares worth RM1.74 billion.

Stocks on Bursa Malaysia ended yesterday mixed due to persistent selling pressure on small-cap stocks. However, gains in heavyweights helped pushed the benchmark FBMKLCI 3.6 points or 0.19% higher to 1,859.34 points, after opening 3.47 points lower and hovered between 1,852.27 points and 1,859.34 points. Market breadth was extremely negative as losers led gainers by 728 to 192 while 256 counters were unchanged. Turnover was higher at 2.5 billion shares worth RM2.2 billion from Monday’s 2.16 billion shares worth RM1.74 billion.

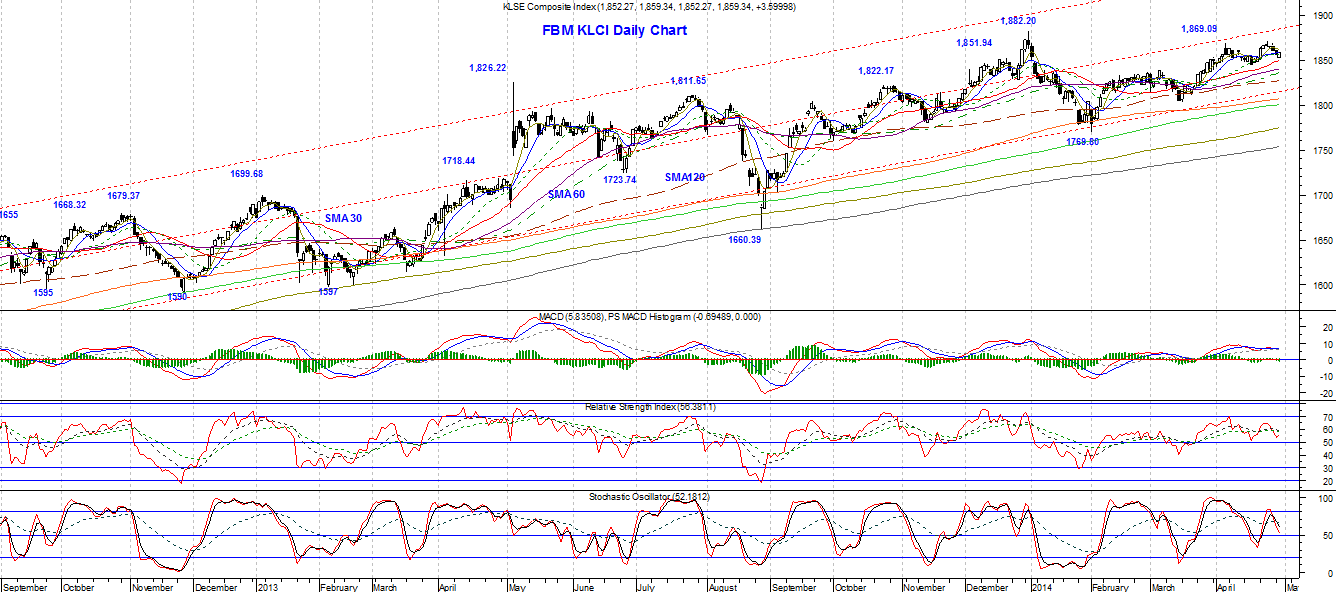

The FBMKLCI opened 3.47 points lower at the intra-day low of 1,852.27 and moved higher gradually throughout the day with mild pullback on profit-taking activity. The key index ended the day at the highest point on continued buying support on selected heavyweight blue-chip stocks. Chart-wise, the FBMKLCI formed a bullish white Marubozu candlestick in a piercing-line position, a bottom reversal candlestick pattern, which indicates a fight back of the bulls after being beaten down for three consecutive sessions. Hence, the FBMKLCI is likely to stage further rebound today in conjunction with the April month-end closing. Immediate overhead resistance is at 1,863, follows by 1,868 and 1,870, while the downside support zone is at 1,852 to 1,845.

MACD and its histogram continued to slip lower, indicating further loss in the index’s momentum. RSI (14) hooked upward to 56.4 from 53.8, reflecting a mild rebound and the short term relative strength has improved to the mildly bullish state from a weakly bullish state. Stochastic was lower at 52.2 from 59.9, indicating further weakness and continuation of the short term down cycle. In short, readings from the indicators showed that the FBMKLCI is still in a state of consolidation.

The short term trend of the FBMKLCI remained down as the index continued to stay below the 5-day SMA. However, the rebound yesterday lifted the key index to close above the 10, 15 and 20-day SMA, indicating a state of range-bound consolidation. Nonetheless, further rebound might be expected on window-dressing activity for month-end closing. The medium and longer term uptrend of the FBMKLCI still remained intact. On the broader market, the bulls run on the small-cap and penny stocks might take a breather as majority of the small-cap and penny stocks suffered big losses that caused a trend change from up to down, which may lead into further consolidation.

Overnight, the Dow rose another 86.63 points or 0.53% to close at 16,535.37. Today, the FBM KLCI is likely to trade within a range of 1,846 to 1,870.

This week's expected range: 1828 – 1892

Today’s expected range: 1846 – 1870

Resistance: 1860, 1865 1870

Support: 1846, 1850, 1853

Stocks to watch: DAYA, KIALIM, KLCC, OLDTOWN, PESONA, SCGM, SENDAI, SMARTAG, SYF, TDEX, TSH

Disclaimer: The content on this site is provided as general information only and should not be taken as investment advice. All site content, shall not be construed as a recommendation to buy or sell any security or financial instrument. The ideas expressed are solely the opinions of the author. The Stocks to watch is not a recommendation to buy or sell the particular stock, as it is only meant for graduates of the "Share Trading the Pro Way" course as case study. Any action that you take as a result of information, analysis, or commentary on this site is ultimately your responsibility. Consult your investment adviser before making any investment decisions.