Stocks on Bursa Malaysia rebounded to close higher yesterday on last-minute buying, which helped push the FBM KLCI into positive territory. The key index swung between gains and losses in the absence of fresh leads and was in a consolidation mode ahead of the US Federal Reserve chairman Ben Bernanke's twice-yearly monetary policy report to the Congress yesterday and today. The FBM KLCI ended 2.27 points higher at 1,788.66, after moving between 1,789.48 and 1,784.47 throughout the day. Market breadth was positive, with 482 gainers and 323 losers, while 288 counters were unchanged. Turnover increased to 1.593 billion shares worth RM2.432 billion from the 1.402 billion shares worth RM1.944 billion on Tuesday.

Stocks on Bursa Malaysia rebounded to close higher yesterday on last-minute buying, which helped push the FBM KLCI into positive territory. The key index swung between gains and losses in the absence of fresh leads and was in a consolidation mode ahead of the US Federal Reserve chairman Ben Bernanke's twice-yearly monetary policy report to the Congress yesterday and today. The FBM KLCI ended 2.27 points higher at 1,788.66, after moving between 1,789.48 and 1,784.47 throughout the day. Market breadth was positive, with 482 gainers and 323 losers, while 288 counters were unchanged. Turnover increased to 1.593 billion shares worth RM2.432 billion from the 1.402 billion shares worth RM1.944 billion on Tuesday.

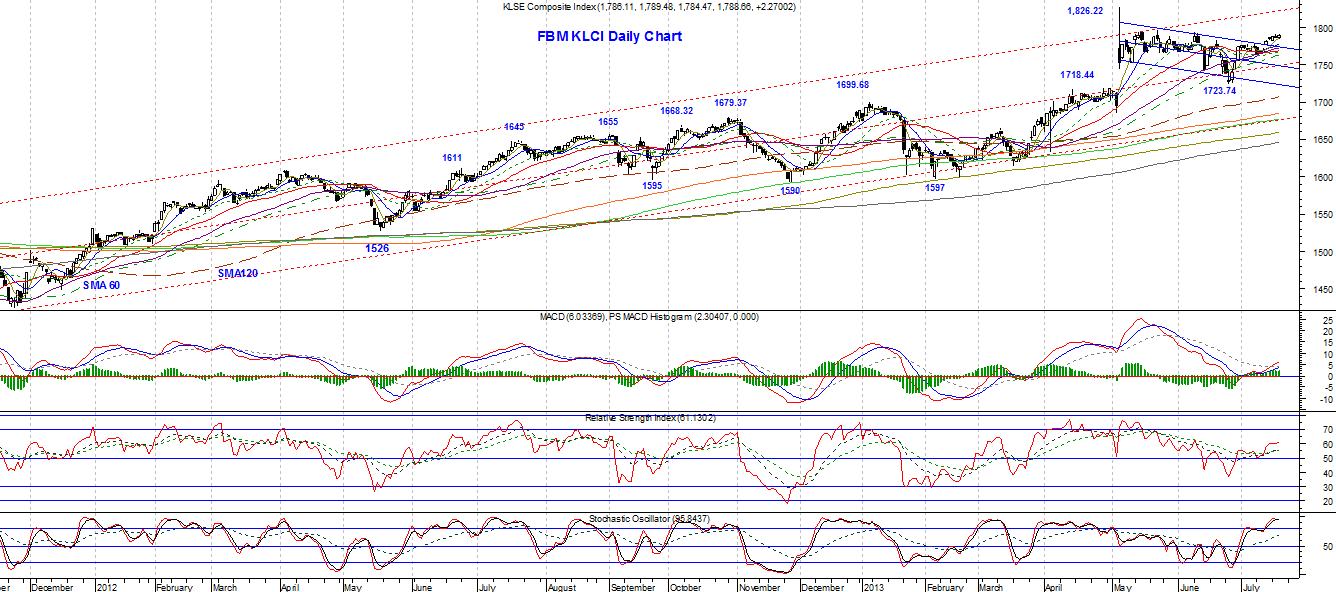

The FBM KLCI opened 0.28 of a point lower at 1,786.11 and slipped to the intra-day low of 1,784.47 within the first two minutes after opening. The key index rebounded quickly and surged to the intra-day high of 1,789.48 within the next half an hour, and again swung lower to move sideways before a last minute buying which pushed the key index to close in the positive territory. Chart-wise, the FBM KLCI formed a small white candlestick which indicates consolidation but with an upward bias. Hence, the FBM KLCI is likely to continue its range-bound consolidation today with a likelihood of moving marginally higher. Immediate overhead resistance is expected at 1,790, follows by 1,792 and 1,795, while the downside support zone is at 1,784 to 1,781.

MACD was higher but its histogram was just marginally higher or almost flat, indicating a state of consolidation with an upward bias. RSI (14) was slightly higher at 61.1 from 60.1, reflecting a mildly gain in the index, and the key index is still in a bullish state. Stochastic slipped lower to 95.8 from 96.7 but is still above the slow stochastic line, indicating a state of consolidation. Readings from the indicators showed that the FBM KLCI is in consolidation but with an upward bias.

The general trend of the FBM KLCI is up, but for the immediate short term, the key index has gone into a sideways consolidation mode as it continues to trade within a narrow range within a bigger sideways range. Nevertheless, as the key index continues to consolidate, rotational play on the second and third liners especially on the oil and gas and construction sectors is likely to continue.

Overnight, the Dow rebounded 18.67 points or +0.12% to close at 15,470.52. Today, the FBM KLCI is likely to trade within a range of 1,780 to 1,795.

This week's expected range: 1745 – 1811

Today’s expected range: 1780 – 1795

Resistance: 1790, 1792, 1795

Support: 1780, 1782, 1785

Stocks to watch: ALAM, GOB, HANDAL, HIAPTEK, IJACOBS, MUHIBAH, NAIM, PERDANA, TAS, TGOFFS, VERSATL, YOCB